12th Standard Accountancy / கணக்குப்பதிவியல் Subjects Question Paper Software Subscription

QB365 covers complete information about Tamilnadu 12th Standard 2022-2023 Accountancy / கணக்குப்பதிவியல் Subject. Question Bank includes 12th Standard 2022-2023 Accountancy / கணக்குப்பதிவியல்'s Book back questions, other important questions, Creative questions, Extra questions, PTA quesions, Previous Year questions and other key points also. All question with detailed answers are readily available for preparting Accountancy / கணக்குப்பதிவியல் question papers.

All Chapters Covered

Create Unlimited Question Papers

Access anywhere anytime

Multiple Pattern Question Papers

Share your Question Paper

Font size, line spacing, watermark etc,

Our Other Subjects 12th Standard

12th Standard Accountancy English Medium Chapters / Lessons 2022-2023

Final Accounts - Adjustments

Accounts from incomplete records - single entry

Depreciation incomplete records - single entry

Financial Statement Analysis - ratio analysis

Cash budget

Partnership accounts - Basic concepts

Partnership accounts - Admission

Partnership accounts - Retirement

Company accounts

12th Standard Accountancy English Medium Chapters / Lessons 2022-2023

Final Accounts - Adjustments

Accounts from incomplete records - single entry

Depreciation incomplete records - single entry

Financial Statement Analysis - ratio analysis

Cash budget

Partnership accounts - Basic concepts

Partnership accounts - Admission

Partnership accounts - Retirement

Company accounts

12th Standard Accountancy English Medium Chapters / Lessons 2022-2023 Syllabus

Final Accounts - Adjustments

Adjustments - Closing Stock - Outstanding Expenses - Prepaid Expenses - Accrued Incomes - Incomes received in Advance - Interest on Capital - Interest on Drawings - Interest on Loan - Interest on Investments - Depreciation - Bad Debts - Provision for Bad & Doubtful Debts - Provision for Discount on Debtors - Provision for Discount on Creditors - Preparation of Final Accounts.

Accounts from Incomplete Records (Single Entry)

Features of Single Entry - Limitations of Single Entry - Difference between Double Entry System and Single Entry - Distinction between Statement of Affairs and Balance Sheet - Methods of ascertaining Profit or Loss - Statement of Affairs Method - Procedure - Conversion Method - Procedure for converting Single Entry into Double Entry System - Calculation of missing figures - Ascertainment of Total Purchases - Ascertainment of Total Sales - Ascertainment of Balances of Sundry debtors and Sundry Creditors.

Depreciation Accounting

Definition - Need for Providing Depreciation - Causes of Depreciation - Terms used for Depreciation - Methods of calculating Depreciation - Straight Line Method - Written Down Value Method - Annuity Method - Depreciation Fund Method - Insurance Policy Method - Revaluation Method - Recording Depreciation - Calculation of Profit or Loss on Sale of Asset.

Financial Statement Analysis - Ratio Analysis

Significance of Financial Statement Analysis - Limitation of Financial Statement Analysis - Ratio Analysis - Definition - Objectives - Classification of Ratios - Liquidity Ratios - Current Ratio, Liquid Ratio and Absolute Liquid Ratio - Solvency Ratios - Debt-Equity Ratio and Proprietory Ratio - Profitability Ratios - Gross Profit Ratio, Net Profit Ratio, Operating Profit Ratio and Operating Ratio - Activity Ratios - Capital Turnover Ratio, Fixed Asset Turnover Ratio, Stock Turnover Ratio, Debtors Turnover Ratio and Creditors Turnover Ratio.

Cash Budget

Budget - Definition - Characteristics - Cash Budget - Advantages - Preparation of Cash Budget - Receipts and Payments Method. Appropriation Account - Goodwill - Method of valuing Goodwill - Average Period Method - Super Profit Method.

Partnership - Basic Concepts

Definition - Features - Accounting rules applicable in the absence of Partnership Deed - Partners Capital Account - Fluctuating Capital Method - Fixed Capital Method - Difference between Fixed & Fluctuating Capital Account - Distribution of Profit - Interest on Capital - Interest on Drawings - Salary, Commission to Partner - Preparation of Profit and Loss Appropriation Account - Goodwill - Method of valuing Goodwill - Average Period Method - Super Profit Method.

Partnership - Admission

Introduction - Adjustments - New Profit Sharing Ratio - Sacrificing Ratio - Calculation of New Profit Sharing Ratio and Sacrificing Ratio - Revaluation of Assets and Liabilities - Undistributed Profit or Loss - Accumulated Reserve - Treatment of Goodwill - Revaluation Method - Capital of New Partner - Preparation of Revaluation Account, Capital Accounts and Balance Sheet after admission of Partner.

Partnership - Retirement of a Partner

Introduction - Adjustments - New Profit Sharing Ratio - Gaining Ratio - Calculation of New Profit Sharing Ratio and Gaining Ratio - Revaluation of Assets and Liabilities - Undistributed Profit or Loss - Accumulated Reserve - Treatment of Goodwill - Payment to the Retiring Partner - Preparation of Revaluation Account, Capital Accounts, Bank Account and Balance Sheet of the Reconstituted Partnership Firm.

Company Accounts

Introduction - Characteristics - Types of Share Capital - Kinds of Shares - Issue of Shares - For consideration - For cash - Issue of Shares at Par - Issue of Shares at Premium - Issue of Shares at Discount - Calls in Advance - Calls in Arrears - Forfeiture of Shares - Reissue of Forfeited Shares - Capital Reserve

Features in Question Paper Preparation software

(or) type Question

Add or Remover

Sub Questions

Adding Notes

Multiple Pattern

All subjects available

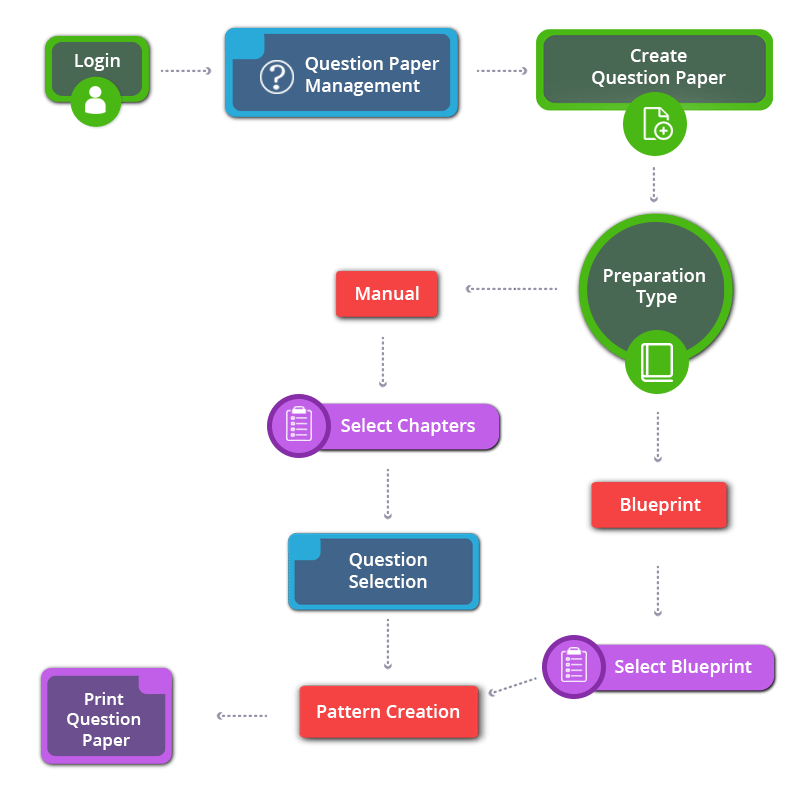

How to Create 12th Standard Accountancy English Medium Question Paper

12th Standard Accountancy English Medium Chapters / Lessons 2022-2023

- Covers all chapters

- Unique Creative Questions

- Unlimited Question Paper

- Multiple Patterns & Answer keys

0